The prominent decentralized perpetual futures exchange, Hyperliquid, has surpassed Coinbase in terms of trading volume, according to Artemis. The data revealed that Hyperliquid recorded $2.6 trillion in trading volume, compared with Coinbase’s $1.4 trillion within the same timeframe.

This represents nearly double the notional volume of Coinbase.

Hyperliquid vs. Coinbase

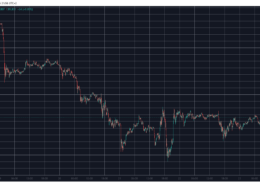

Findings shared by Artemis also disclosed that the year-to-date price performance highlights a stark contrast between the two platforms. Hyperliquid has gained 31.7% so far in 2026, while Coinbase has declined by 27.0%. This resulted in a divergence of 58.7% over just a few weeks.

Coinbase is one of the most established centralized exchanges in the world, while Hyperliquid is still an emerging decentralized player in the space. Following the significant gap in both trading activity and asset performance, Artemis described it as a sign that the market is paying attention to the decentralized perpetuals exchange’s rapid growth.

Throughout 2025, the platform generated $822 million in revenues. So far this year alone, it recorded $79.1 million in revenues.

Meanwhile, open interest on Hyperliquid, over the past 24 hours, stood at $4.1 million.

Amid rapid growth, Ripple announced that its Ripple Prime brokerage platform will now support Hyperliquid. This would allow institutional clients to access Hyperliquid’s on-chain derivatives while cross-margining exposure across other assets, including cleared derivatives, OTC swaps, fixed income, forex, and digital assets, under a single counterparty.

Michael Higgins, international CEO of Ripple Prime, said the integration merges decentralized finance with traditional prime brokerage, improving liquidity access and trading efficiency. The move comes as Hyperliquid continues to see billions in daily volumes, as the platform sees growing influence in the decentralized perpetual futures market.

HYPE Shorting Controversy

Hyperliquid’s popularity has not been without controversy. In December, the exchange confirmed that a former employee, dismissed in early 2024 for insider trading, was behind large short positions in its native HYPE token. On-chain analysis verified that the wallet responsible executed leveraged shorts totaling over $223,000, including $180,000 in HYPE at 10x leverage.

The platform reiterated its zero-tolerance policy for insider trading and said employees and contractors are prohibited from trading HYPE derivatives.

The post Hyperliquid Records $2.6T Volume, Leaving Coinbase Behind: Artemis appeared first on CryptoPotato.

Source link