Bitcoin is expected to rally 20% short term, but there’s a catch.

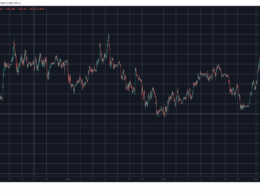

Crypto prices fell as investors pulled back risk ahead of U.S. economic data, continuing a weak December trend. Bitcoin briefly slipped toward $85,300 before climbing to nearly $86,200. The cryptocurrency is still down by more than 4% over the past week

Amid the ongoing downside pressures, a prominent analyst believes that Bitcoin could revisit the $97,000-$107,000 zone before a deeper correction.

Bitcoin’s Next Move

Crypto market analyst Doctor Profit said he expects Bitcoin to see a short-term rebound before resuming a broader bearish trend, as he warned traders to remain highly cautious. The analyst said he is buying back BTC around the $86,000 level to trade a potential relief rally over the coming weeks tactically.

According to him, there is a reasonable probability that BTC could revisit the $97,000 to $107,000 range before the next major leg lower begins. He described this as roughly a 20% upside move from current levels, which offers a favorable risk-reward opportunity if managed with strict discipline.

However, the analyst admitted that his overall outlook remains firmly bearish and said the trade is short-term only, which will be executed with what he called the highest level of risk management. This includes placing a stop loss at the entry level once the position moves into solid profit. Doctor Profit also noted that his existing short positions, opened in the $115,000 to $125,000 range, remain fully active and unchanged.

He warned that BTC remains extremely unstable and vulnerable to sharp downside moves, while adding that a deeper and faster sell-off could occur at any time, even before the price reaches the $97,000-$107,000 zone. As a result, he said buying at current levels should be approached with extreme caution. Any upside represents distribution and liquidity for the next decline, while the $70,000 region is still firmly in focus as the main downside target.

Conflicting Targets For 2026

Recently, another pseudonymous analyst, Mr. Wall Street, warned that BTC could face a deeper correction after a brief rebound toward $100,000. He even forecasted a deeper drop to $54,000-$60,000 by the fourth quarter of 2026. He is not alone.

You may also like:

Some of Wall Street’s biggest Bitcoin bulls have scaled back their price targets. While their long-term optimism remains, expectations have become more cautious. Standard Chartered recently cut its Bitcoin forecast in half and is now targeting $150,000 by the end of 2026. Bernstein analysts also echoed the revision and projected $150,000 for late 2026.

On the other hand, analyst Wise Crypto predicted not so long ago that easing US monetary policy, improving liquidity, and political tailwinds could drive a major upside move, and the crypto asset could end up rising into the $300,000-$600,000 range next year, even as the current state of the market disagrees.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Source link