Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

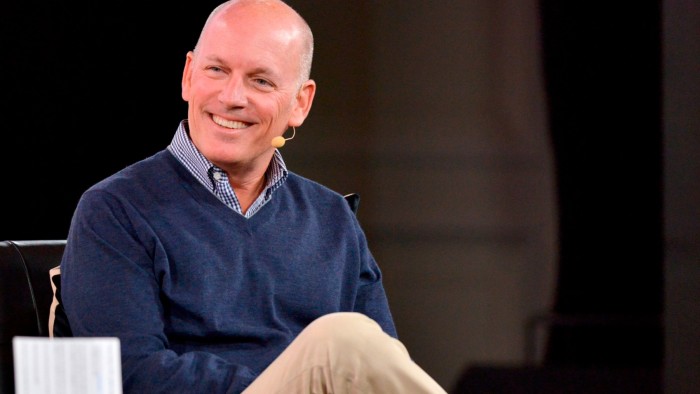

Getty Images boss Craig Peters said the group would rethink the extent of its operations in the UK if the country’s competition watchdog blocked its attempted takeover of US rival Shutterstock.

Peters said the Competition and Markets Authority was overlooking how quickly AI is reshaping the image-generation market.

Getty Images and Shutterstock are US-listed groups that sell visual content and together would create a company worth $3.7bn.

This month, the CMA referred the deal, which was announced in January, to an in-depth phase 2 investigation, warning it could significantly reduce competition.

Peter said this process would cost the groups more than $50mn, saying: “It’s a really expensive appeal for . . . a very small portion of businesses in the UK.”

If the deal is blocked, he said, “there’s parts of these businesses that probably don’t continue to invest in the UK. There are pieces of this business that potentially exit [and] ultimately investments that aren’t going to be made.”

Getty and Shutterstock face the threat of their professionally shot photos and videos being replaced by AI platforms that can generate images from text prompts. Digital image providers such as Adobe and Canva also offer alternatives.

“This transaction is about taking a Shutterstock business that is in decline in terms of its licensing revenues and being impacted by AI, combining it with Getty and creating scale,” said Peters. “We can’t go buy a Google. We can’t go buy an OpenAI. And so we need to compete in a different way.”

In its initial phase 1 decision, the CMA said its evidence indicated that the two companies were the main competitors for each other, alongside PA Media/Alamy and Adobe Stock. The evidence on Canva was more mixed, it said.

Peters said: “We fundamentally believe that this merger is not anti-competitive. We believe it is pro-growth and ultimately good for the market.”

The CMA said: “During our initial investigation we heard widespread potential concerns about this deal — particularly around its impact on UK news outlets and advertisers . . . We also heard arguments around the evolving impact of AI in this market.

“It is right that we investigate further to understand whether businesses here in the UK could face higher subscription costs or get a worse service.”

Peters argued that the CMA is using too narrow a definition of the market in assessing competition and that the two groups were now up against US tech giants with vast budgets developing image generation tools.

AI, he said, was causing huge changes in the market, “larger than the internet, larger than digital photography, larger than social media”.

The CMA said it had not seen evidence that AI generated images “are either currently, or likely to be in the next few years, an alternative to stock content for a significant proportion of demand”.

Like other media groups, Getty is fighting AI companies it accuses of using its copyrighted material without permission, with a lawsuit against Stability AI in the US and UK its most high-profile effort to defend its intellectual property.

Peters said: “Ignoring technology like AI is something that I can’t get my head wrapped around — saying that it’s three to five years out? Really? The fastest adoption of technology in the history of human beings . . . and yet it’s three years out?”

Getty covers more than 160,000 news, sport and entertainment events, and has a photographic archive with millions of images dating back to the early days of photography. It also has its own generative AI technology and tools trained on its content.

Source link