Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Japanese trade negotiators trying to spare their country from Donald Trump’s tariffs are preparing to do battle over an issue where neither side can easily back down: a car safety test that does not exist.

Trump has perplexed officials in Tokyo with a reference to a Japanese “bowling-ball” test — dropping a bowling ball on to a car and failing any vehicle if its bonnet dents under the impact.

The US president first referred to the test in 2018. “They take a bowling ball from 20 feet up in the air and they drop it on the hood of the car. And if the hood dents, then the car doesn’t qualify,” he said. “It’s horrible, the way we’re treated.”

On Sunday he again cited the test on his Truth Social platform as an example of “protective technical standards”.

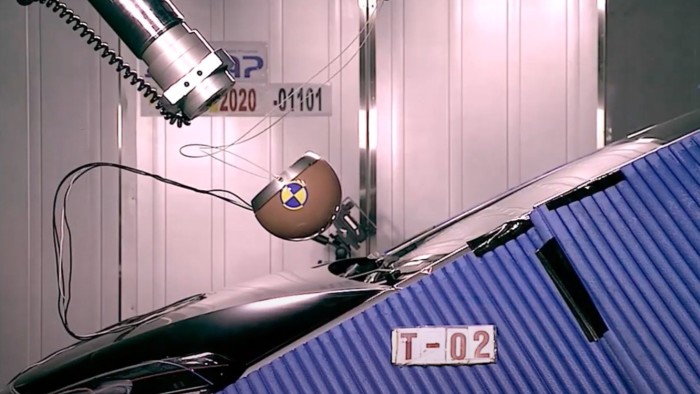

Japan does not carry out such tests on its cars, although one carried out in the country and elsewhere does entail hitting a car with a rounded object at a speed of 35kph, to simulate an impact with a pedestrian. In the test, a dent in the bonnet typically indicates good shock absorption and a potentially less deadly impact.

It is part of a UN-formulated safety regime that closely resembles Europe’s and puts new car models through tests on 43 items. The US has its own proprietary car safety testing regime that diverges from UN standards.

Japan has lots at stake in the trade negotiations with the US, which Tokyo’s chief negotiator, Ryosei Akazawa, will resume in Washington next week. Trump has threatened its export-oriented economy with 24 per cent “reciprocal tariffs” on top of levies on cars and metals, and has previously suggested that cars will be high on the agenda.

“94 per cent of the cars in Japan are made in Japan. Toyota sells one million foreign made automobiles into the United States and General Motors sells almost none,” said Trump on the day that reciprocal tariffs were announced in early April.

US complaints about imbalances with Japan in car exports are not new. “There are many Japanese cars in America. I want to see more American cars in Japan, as well,” Barack Obama said on a visit to Japan as president in 2015.

Some US brands such as Jeep and Tesla have made inroads in Japan but 2024 fiscal year sales of up to 17,207 units for US brands were a fraction of the 4.57mn passenger cars sold in Japan, according to official data.

Some US carmakers admit that has little to do with non-tariff barriers.

“There are little quirks but they are remnants of a bureaucracy of a system that has been changing slowly. Are they non tariff barriers? Yes, they are as it takes more time and money to comply,” said Pontus Häggström, who led Fiat Chrysler in Japan for more than a decade and is now regional director of Alpine, Renault’s sports car brand.

“Is this the reason why US cars are not selling in Japan? The answer is completely not.”

One senior advertising executive in Tokyo, who worked on marketing US car brands in Tokyo during the 1990s and early 2000s, said selling American cars to Japan was a challenge because they are “too big, consume too much gas, and lack the little design details that the customer here looks for”.

While Japan remains in search of compromises that might appeal to Trump, any compromise on safety standards might not be accepted by prime minister Shigeru Ishiba, who is trying to shore up his popularity and has repeatedly referred to Trump’s tariffs as having precipitated a “national crisis”.

“Be it cars or agricultural products, we will not do anything that will affect safety,” he told a parliamentary session this week.

But Japan might have ground to cede on other non-tariff barriers for imported vehicles, including subsidies that favour local producers such as Toyota and Japan’s unique fast-charging standards for electric vehicles, according to auto executives.

“If Japan wants to offer something, then they can do it on the EV front as there are some barriers there,” said Ludwig Kanzler, chief executive of Hanegi Solutions, a consulting firm that has advised South Korea’s Hyundai on market entry to Japan.

Source link