Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

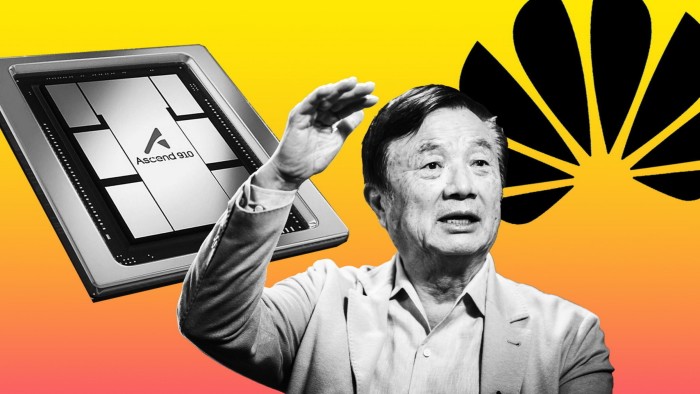

Huawei has significantly improved the amount of advanced artificial intelligence chips it can produce, in a key breakthrough that supports China’s push to create its own advanced semiconductors.

The Chinese conglomerate has increased the “yield” — the percentage of functional chips made on its production line — of its latest AI chips to close to 40 per cent, according to two people with knowledge of the matter. That represents a doubling from 20 per cent about a year ago.

The move represents an important advance for Huawei, which has been rolling out its latest Ascend 910C processors, which offer better performance than its previous 910B product.

The improved yield means that Huawei’s production line for Ascend chips has become profitable for the first time, according to the people with knowledge of its business. The company has a goal to further improve yields to 60 per cent, in line with the industry standard for similar chips.

The breakthrough is a step forward for China’s hopes to build computing infrastructure that can support its burgeoning AI industry, despite US export controls designed to hamper the country’s ability to develop sensitive technologies.

The effort has state support, with Beijing urging local tech companies to buy more of Huawei’s AI chips and shift away from $3.3tn US chipmaker Nvidia, which remains the market leader in China by far.

Huawei founder Ren Zhengfei told Chinese President Xi Jinping last week that the worries China had about a “lack of core and soul” had eased, adding “I firmly believe a greater China will rise faster”, the People’s Daily reported.

The phrase “lack of core and soul” dates back to a 1999 comment by a former China technology minister about the country’s information industry, with “core” referring to semiconductors and “soul” referring to operating systems.

Huawei’s recent progress is also significant to achieving China’s goal of reaching full independence for advanced chip production.

The world’s leading chip manufacturer, Taiwan Semiconductor Manufacturing Company, was forced to stop making Ascend chips and advanced smartphone chips in 2020, after Washington blocked Huawei from accessing manufacturing that used US technology.

Austin Lyons, semiconductor analyst with consultancy Creative Strategies, compared Huawei’s production milestone to TSMC’s estimated 60 per cent yield for production of Nvidia’s H100 AI processor, a similarly sized chip. On that basis, it is possible that a rival product such as Huawei’s would be commercially viable at a 40 per cent yield, he said.

Huawei partnered with the sanctioned Chinese fabrication group Semiconductor Manufacturing International Corp to relaunch its Ascend chip.

SMIC currently uses its so-called N+2 process, which is capable of producing advanced chips without extreme ultraviolet technology. China is currently banned from purchasing EUV lithography machines, the most cutting-edge chipmaking equipment from Dutch group ASML.

Shenzhen-based Huawei plans to produce 100,000 910C processors and 300,000 910B chips this year, said people with knowledge of its plans. This compares with 200,000 910B and no mass production of 910C in 2024.

The figures suggest that Nvidia will still sell more AI chips in China than Huawei, despite the US company only being able to sell Chinese customers its H20 chips, a less powerful version of its H100 chips designed to adhere to Washington export controls.

The consultancy SemiAnalysis has estimated that Nvidia made $12bn selling 1mn of its H20 chips to China last year.

Huawei faces challenges to convince more customers to abandon Nvidia. One person close to the business pointed to Nvidia’s Cuda software, which is known for being easier to use and capable of faster data processing than Huawei’s offerings.

AI companies and Huawei researchers have also said that the Ascend 910B did not work well for large-scale model training, because of problems with inter-chip connectivity and memory issues.

Huawei has been trying to improve these issues by working with partners to resolve software bugs and increase memory capacity in its latest 910C series.

However, Huawei has still emerged as the frontrunner to challenge Nvidia in the market for so-called “inference” chips, the hardware used to run AI models once they have been trained.

Prospective customers for the Ascend chip have also cited difficulties securing supplies, with Huawei prioritising orders for large state-run cloud providers like China Mobile.

Huawei currently accounts for more than three-quarters of the overall output of AI chips in China, said one of the people with knowledge of its business. The smaller rivals have struggled to compete with Huawei to get enough capacity at SMIC’s leading nodes, the person added.

Huawei declined to comment.

Additional reporting by Tim Bradshaw in London and Ryan McMorrow in Beijing

Source link