Stay informed with free updates

Simply sign up to the US interest rates myFT Digest — delivered directly to your inbox.

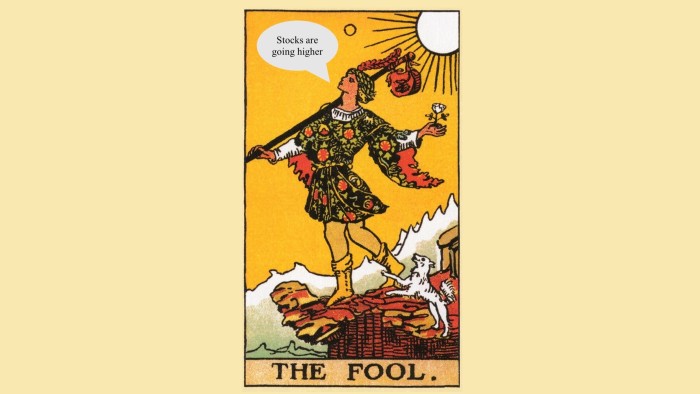

Judging by his latest “diary of a quant”, Man AHL’s Russell Korgaonkar is as exhausted by the end-of-year investment outlook blizzard as we are. And as he points out, strategists aren’t, umm, great at predicting the future.

Man AHL has long been very hot for the idea that volatility is actually the best way to predict the near future and dial up and down your exposure accordingly. It’s the main (self-serving) point of Korgaonkar’s post.

“Volatility scaling,” Man AHL calls it, but elsewhere the approach is usually call volatility targeting. It’s widely used in the trend-following hedge fund space, risk parity and variable annuity products, and forms the basis for value-at-risk models that are virtually everywhere.

It has its critics — who argue it embeds automated feedback loops into markets — but it’s true that volatility tends to cluster. It’s equally true that nothing will stop the Wall Street-Industrial Complex from churning out extremely predictable annual investment outlooks.

However, we mainly wanted to highlight the report for a beautiful, updated version of one of Alphaville’s favourite-ever chart formats: implied rates forecasts over time, and what rates have actually done.

It’s an oldie but a goody, and we reckon it’s good to resurface from time to time as a reminder of how hard it is to make predictions, especially about the future. Please bear that in mind as we enter 2025!

Source link