Unlock the White House Watch newsletter for free

Your guide to what the 2024 US election means for Washington and the world

The writer is the author of ‘Chip War’

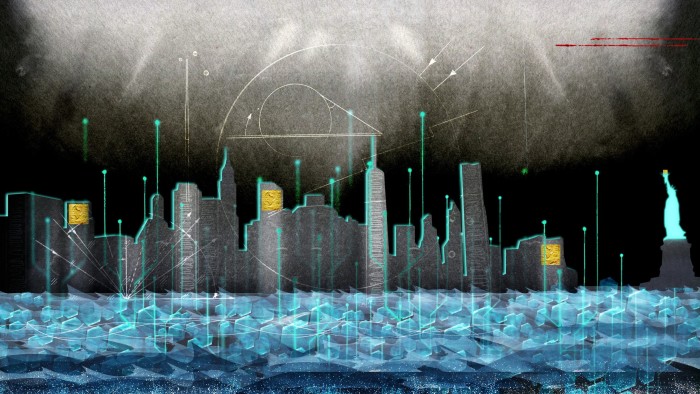

What does the return of Donald Trump imply for the global chip war? Trump didn’t start the subsidy race — credit here goes to Chinese leader Xi Jinping — but his first administration focused the US on tech competition with China. Biden then extended Trump-era policies regarding tariffs, subsidies, and export controls. Now Trump is returning just as artificial intelligence intensifies demand for computing power.

For the chip industry, the immediate focus is tariffs. Trump’s first term drove the sector towards a costly supply chain restructuring, with electronics assembly shifting from China to Mexico and south-east Asia. More tariffs on China are certainly coming. But some south-east Asian countries whose electronics exports have driven higher trade surpluses with the US are also in the crosshairs.

Yet not every US chip company opposes every type of tariff. To protect industry segments impacted by heavily subsidised Chinese competitors, Washington is exploring “component tariffs” — that is, taxing imports based not on the location of final assembly but on the components inside. Today, a device assembled in Vietnam containing Chinese chips pays the tariff rate for Vietnam, not China. A component-based tariff regime would target Chinese chips, regardless of where final assembly occurs. Such a policy would fit Trump’s desire to tackle Chinese subsidies with more limited cost to companies and consumers than broad-based tariffs.

Export controls on US companies shipping AI chips and chipmaking tools to China were another Biden expansion of a Trump-initiated policy. It was Trump who first targeted Huawei. The Biden administration has since cut exports to over a hundred companies it says are Huawei-affiliated. It was Trump who worked with the Dutch government to ban sales of cutting-edge lithography machines to China; Biden expanded those restrictions.

Congressional Republicans have pointed out numerous loopholes in existing export controls that the new administration may seek to close. Allies might complain but some quietly prefer unilateral US measures that prevent them from having to take tough decisions in the face of domestic pressure and Chinese retaliation. Either way, the coalition restraining tech transfer to China will remain imperfect but should hold together.

What of domestic US manufacturing? The recent departure of Intel chief executive Pat Gelsinger underscores the challenges that the company — central to Biden’s chip strategy — faces, despite negotiating billions of dollars in grants under the 2022 Chips Act.

On the campaign trail, Trump suggested that, instead of subsidising chip firms, tariffs might do more to encourage domestic production. But imposing tariffs on partners like Taiwan, whose exports to the US have surged thanks to Nvidia, would harm Silicon Valley too. The Arizona investment by Taiwan’s leading chipmaker, TSMC, was announced by the first Trump administration. It isn’t hard to imagine another round of investments to bolster supply chain security.

With facilities under construction in multiple states, the Chips Act now has deep bipartisan support. Republican House Speaker Mike Johnson recently discovered exactly how deep. On the campaign trail, he floated repealing it, sparking an internal Republican rebellion. Now he promises to “further streamline and improve” the bill by eliminating “costly regulations.” Chip companies — who have complained about labour, childcare and permitting rules — would welcome this. The new Congress may even extend the generous investment tax credit for chip plants.

The biggest uncertainty overhanging the chip industry is the future of AI demand. Companies from Nvidia to TSMC have been buoyed by investments in AI data centres. Trump advisers say they want to accelerate data centre construction by streamlining permitting and encouraging electricity production. The presence in Trump’s inner circle of Elon Musk — whose xAI company operates one of the world’s largest AI chip clusters — suggests AI will be a focus. Washington is abuzz with ideas to accelerate AI, from rezoning federal-owned land for data centre construction to establishing a “Manhattan Project” for AI.

But the Chips Act already created a mini-Manhattan project by allocating over $10bn in R&D programmes via the Chips Act. Much of this remains unspent. It takes multiple years to build a chip plant and even longer to see fruits from R&D. If the new Trump administration wants to reset chip policy — and if it wants visible results within four years — it had better start soon.

Source link