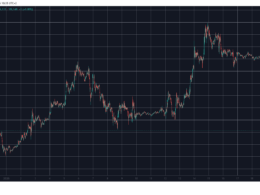

Economists at the United States Treasury analyzed IRS data from households reporting cryptocurrency holdings on their annual tax returns and found that crypto ownership nearly tripled between 2020 and 2021, the most recent year with available tax data.

The areas with the highest levels of crypto exposure in 2021 also experienced significant increases in both mortgage and auto loan origination and balance figures in the following years.

Crypto Gains and Larger Mortgages

The report revealed that for low-income households in areas with high crypto exposure, the mortgage rate jumped from 4.1% in January 2020 to 15.4% in January 2024, almost four times higher. The average mortgage balance increased by over 150%, from almost $172K to a little over $443K, indicating that profits from crypto sales may have helped with larger down payments.

Low-income households in high-crypto areas earn an average of $40,664, which results in a mortgage debt-to-income ratio of 0.53, well above the recommended 0.36 and the 0.43 required for some standard loans. The report suggests that this high ratio is concerning because it’s linked to a greater risk of default, particularly during financial crises.

On the other hand, in low-crypto areas, low-income households have a much lower debt-to-income ratio of 0.19, with an average mortgage balance of $136,481 and income of $35,950. This suggests that the rise in mortgage debt in recent years may be mainly happening in high-crypto areas, which might increase financial instability.

From 2020 to 2024, mortgage delinquency rates dropped across the board, particularly among low-income households. The decline in delinquency was similar across areas with high and low crypto exposure.

For example, delinquency fell by 4.2% in high-crypto areas and 3.8% in low-crypto areas for low-income groups. High-crypto areas had lower delinquency rates in 2020, so the percentage drop was bigger there. For high-income households, delinquency rates showed little change. As of Q1 2024, delinquency rates are at their lowest in 15 years, around 1.7%, with no signs of “distress” in high-crypto areas.

Auto Loan Debt Hits $1.6T, Crypto Areas See Largest Increases

Auto loan debt has surged to over $1.6 trillion as of early 2024, with notable increases among low-income households, particularly in high-crypto exposure areas. Between 2020 and 2024, average auto loan balances for low-income households grew by 52% in high-crypto areas compared to a 38% rise in low-crypto areas. This could potentially suggest that crypto earnings or windfalls may have enabled more vehicle purchases.

On the other hand, middle- and high-income households saw decreases in their average auto loan balances during the same period, though those in high-crypto areas experienced smaller declines or even slight increases.

Despite these shifts in borrowing, delinquency rates on auto loans remained relatively stable for middle- and high-income groups, indicating that the rise in auto debt has not yet translated into widespread financial distress.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Source link