Stay informed with free updates

Simply sign up to the Energy sector myFT Digest — delivered directly to your inbox.

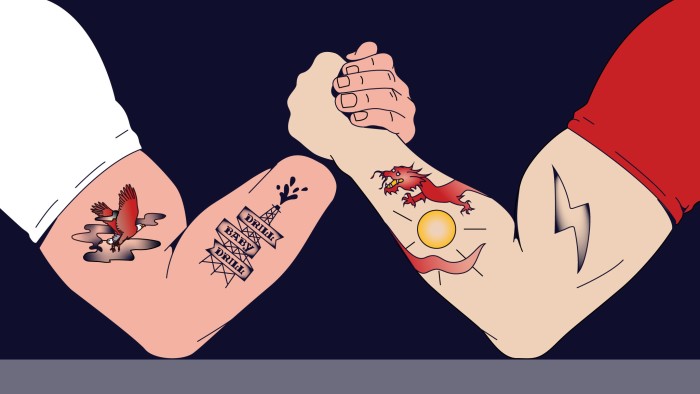

The world seems to be entering a new era, and one of the most important questions is what that will mean for energy. A brief summary: clean sources of energy are more abundant and cheaper than ever before. The number one clean-energy superpower (and, confusingly, also the largest carbon emitter) is China. However, the US president-elect is a climate denier who loves fossil fuels and is promising an anti-China trade war. To complicate that, he has adopted as his chief sidekick the world’s first clean-energy oligarch, Elon Musk. Given these ingredients, what’s the future for energy?

Before the US elections, I visited Fatih Birol, head of the International Energy Agency in Paris. The IEA publishes the annual World Energy Outlook, considered the sector’s Bible. Birol told me that the “age of oil and gas” is gradually giving way to the “age of electricity”, largely powered by renewables and nuclear.

The IEA predicts that renewables, mostly solar, will account for four-fifths of all new power generation capacity through to 2030. Birol says countries are choosing renewables not to stop climate change. They’re doing it because renewables are now often cheaper than fossil fuels. Prices of most clean-energy technologies — solar, wind, lithium-ion batteries and battery storage — are around their lowest ever.

There’s even enough renewable capacity to handle the coming leap in electricity use. Through to 2035, demand for electricity will rise six times faster than total energy demand, the IEA projects. That’s because of the new electric vehicles, but also the rising use of air-conditioners, AI data centres and electric appliances. There is a cheering underlying factor: more than 90 per cent of humans now have electricity, largely because South Asia has connected its poor to the grid. About 750 million people remain without power, mostly in sub-Saharan Africa.

The age of electricity will reduce carbon emissions, but not by enough. Consumption of fossil fuels, now at an all-time high, is set to peak around 2030, but remain almost as strong afterwards, says the IEA. Terrifyingly, it projects that global temperatures are set to rise 2.4C by 2100 unless countries change policies.

Still, clean-energy technology will grow into a giant industry. The IEA says its market size “is set to nearly triple by 2035, to more than $2tn”, about the current average annual value of the global crude oil market. As the champion of clean technologies, China could “win” the next economic era as it did the previous one — unless Donald Trump can stop it. “China is like Real Madrid in the Champions League,” says Birol, a keen football fan. “Almost every energy story today is essentially a China story.” The country dominates clean energy. Take the biggest green industries: battery cells, solar photovoltaic modules, wind nacelles, the refining of critical minerals such as lithium and the production of EVs. China’s average share of these global supply chains is about 70 per cent.

The US is a very distant second, boosted by Joe Biden’s Inflation Reduction Act, which threw capital at green industries. If Trump bins the IRA, as he might, China’s lead would only grow. My own conclusion: Europe isn’t even competing. Some European countries gave away their early lead in solar, shifted away from nuclear, then relied on Russian oil and gas.

Trump has threatened China with 60 per cent tariffs. Given that this is a battle for the next economy, and he is a protectionist China hawk who doesn’t believe in alliances, the logic is that he will also pressure Europe and others to shun Chinese technologies.

Yet investors expect Musk’s EVs to prosper under Trump. Since election night, Tesla’s market value has jumped by $190bn, which is more than the combined capitalisation of Ford, General Motors and Stellantis. And Americans will buy other clean technologies too if they’re cheap and efficient, despite Trump pushing fossil fuels.

One big positive for consumers and governments: energy prices may moderate in coming years. The IEA foresees a potential glut of oil and natural gas, and that’s before Trump starts handing out drilling licences. Russia and the Gulf states will keep selling fossil fuels, but in a world with more renewables and EVs, they’ll get paid less for them. Oil regions could decline the way coal regions such as West Virginia did.

The endgame: China aims to sidestep Trump’s trade war and dominate the new economy. Musk wants a piece of the action.

Email Simon at simon.kuper@ft.com

Follow @FTMag to find out about our latest stories first and subscribe to our podcast Life and Art wherever you listen