Bitcoin (BTC) is trading at near $91,700 at press time, down almost 2% in the last 24 hours. Over the past week, it has gained 4%. The focus now is shifting from short-term price swings to what’s happening with supply on exchanges. Fewer coins are being held on trading platforms, even as the price stays near $92,000.

Exchange Supply Hits Lowest Levels Since 2018

The share of Bitcoin held on exchanges has dropped to around 13.7%, the lowest since 2018. Binance holds only 3.2% of the total supply, based on recent on-chain data. According to CryptosRus, this is part of a multi-year trend, not a temporary shift. Fewer inflows suggest holders are not preparing to sell.

The asset has climbed steadily without signs of large deposits to exchanges. This behavior contrasts with past cycles, where increases in exchange inflows often led to corrections. So far, that isn’t showing up now.

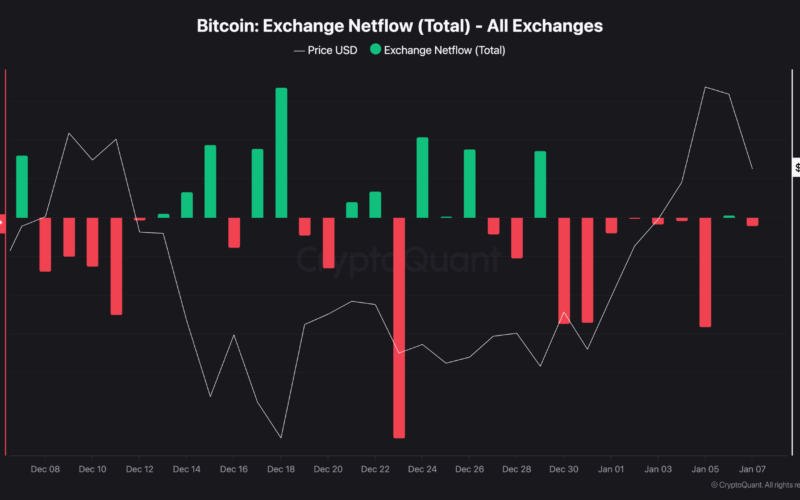

Supporting this, netflow charts show consistent outflows in recent weeks. On several days, especially December 22 and January 5, large amounts of BTC moved off exchanges. These outflows suggest buyers are moving coins into cold storage or long-term wallets.

Even as Bitcoin pushed near $95,000 and later pulled back, exchange inflows remained low. The lack of BTC being deposited to exchanges supports the view that fewer holders are looking to sell, even with the price near local highs.

Adding another layer to the current picture, there’s some debate around long-term holder supply data. Analyst CW flagged an issue tied to Coinbase wallet migration in November. They said, “The Coinbase wallet migration… is counted as a decrease in LTH supply,” but that data may not reflect actual movement by long-term holders.

CW added that “over 500k $BTC” should be included in long-term supply figures. If accurate, it means current estimates understate how much BTC is being held off exchanges.

Price Choppy Around $93K as Traders Watch Levels

Bitcoin has shown more volatility this week. After hitting nearly $95,000, it dropped below $91,500 before bouncing back near $93,000. Traders are watching price levels.

Lennaert Snyder said, “$BTC is trying to choose a direction here,” and pointed to $93,800 and $96,500 as key levels to watch. He also mentioned a potential downside if the market fails to hold $91,200.

Elsewhere, Michaël van de Poppe noted that price is holding above the 21-day moving average. He said the market is still in a range but could continue higher if that level holds. The $100,000 mark remains in focus if momentum builds and supply stays tight.

The post Bitcoin (BTC) Drops Below $92K But Supply Keeps Shrinking appeared first on CryptoPotato.

Source link