Bitcoin’s price has been consistently making higher highs and lows over the past couple of months, approaching a new all-time high.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

On the daily timeframe, the price has been rallying since its rebound from the $52K support level.

While the market has broken above the key 200-day moving average, located around the $64K level and the $68 area, it has failed to break above the all-time high.

The price is currently dropping toward the $68K support level but it seems likely to rebound higher and make a new record high soon, as the market structure is still bullish.

The 4-Hour Chart

Looking at the 4-hour chart, the market has been trending higher inside an ascending channel. Yet, it has been rejected from the channel’s upper boundary recently and is currently testing the lower trendline. If the range holds, the market is likely to rally toward a new all-time high soon.

However, a breakdown could lead to a correction toward the $64K or even the $60K level in the coming weeks.

Sentiment Analysis

By Edris Derakhshi (TradingRage)

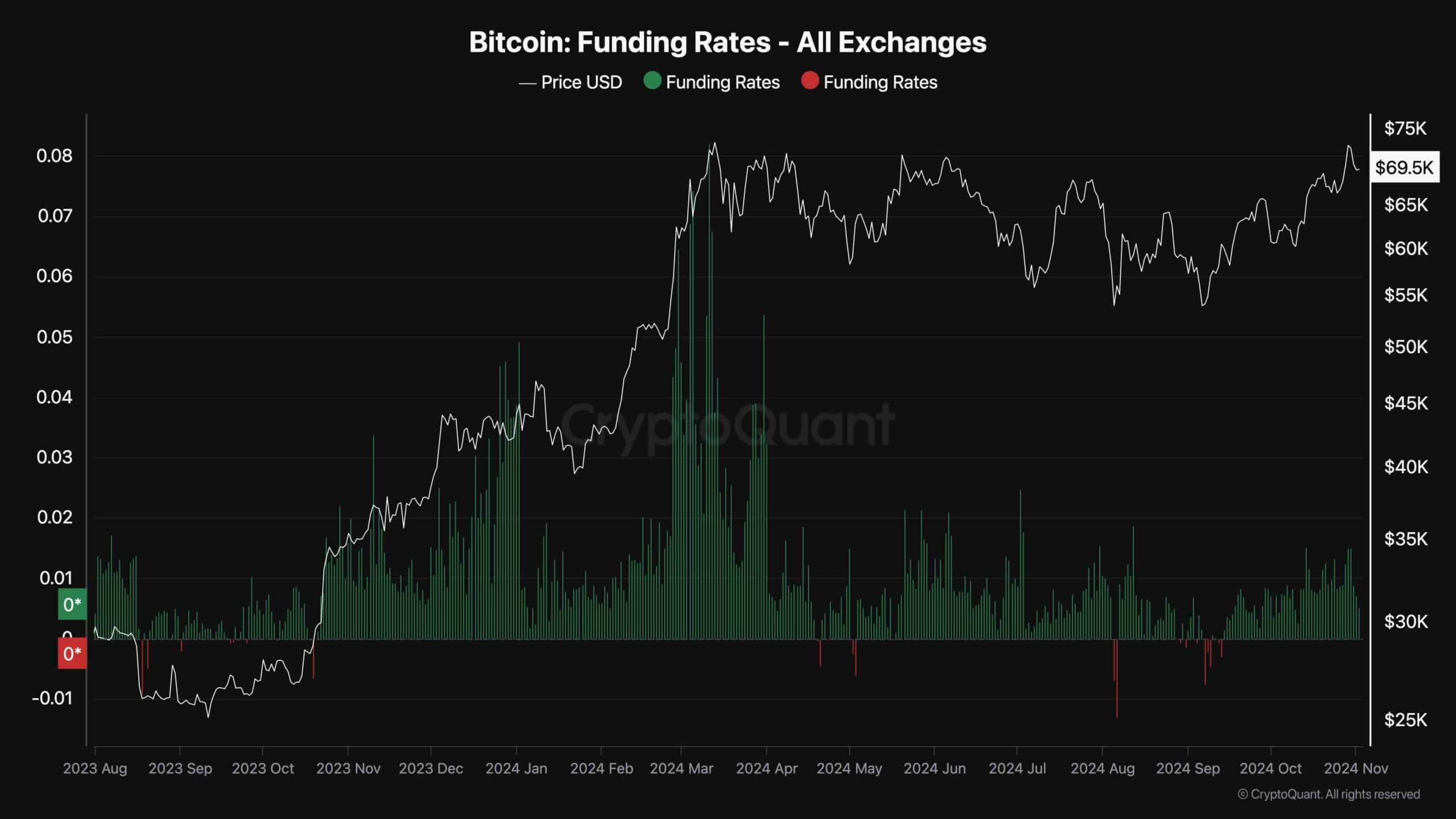

Bitcoin Funding Rates

The futures market has significantly influenced the BTC price action over the past few years. Therefore, analyzing its aggregate sentiment can help anticipate future market trends more accurately.

This chart presents the Bitcoin funding rates metric, which measures whether the buyers or the sellers are executing their leveraged positions more aggressively. Positive values indicate bullish sentiment, while negative values indicate bearish expectations.

As the chart displays, the funding rates have been printing positive values during the recent uptrend.

Yet, these values are still much lower than the funding rates witnessed during the last all-time high in March. Therefore, it can be concluded that the futures market is still not overheated, and with sufficient spot demand, higher prices could be expected in the coming weeks.

The post Bitcoin Price Analytics: BTC Tumbles 3% Overnight but How Low Can It Go? appeared first on CryptoPotato.

Source link