The Bank of England (BOE) in the City of London, UK, on Monday, Dec. 15, 2025.

Bloomberg | Bloomberg | Getty Images

The Bank of England voted narrowly to cut interest rates on Thursday, in its last monetary policy move of 2025.

The central bank’s nine-member monetary policy committee (MPC) on Thursday voted 5-4 to trim the benchmark interest rate by 25 basis points to 3.75%, marking the fourth cut of the year.

Economists had widely expected the rate trim, which comes at a time of lackluster economic data, softening labor market and a recent decline in inflation that outpaced expectations.

Nonetheless, the vote was a narrow one, with BOE Governor Andrew Bailey siding with more dovish members of the committee rather than the four policymakers who maintain that the inflation rate, at 3.2% in November, is still far from the central bank’s 2% target.

In a statement, the MPC said that while inflation remained above target, “it is now expected to fall back towards target more quickly in the near term.”

However, it cautioned that “the extent of further easing in monetary policy will depend on the evolution of the outlook for inflation.”

On the basis of current evidence, the MPC said the, “Bank Rate [the BOE’s benchmark interest rate] is likely to continue on a gradual downward path. But judgements around further policy easing will become a closer call.”

For now, the cut in rates will be welcomed by hard-pressed consumers as it makes borrowing cheaper, but many lose out with lower returns on their savings.

Outlook for 2026

Economists expect the central bank could next cut in early 2026 if macroeconomic data continue to allow for more room or manouver. There are caveats to those forecasts, however.

“Further easing clearly looks likely beyond the December meeting,” Allan Monks, chief U.K. economist at JPMorgan, said in analysis Wednesday. JP Morgan’s current base case is for two more cuts in March and June, bringing the base rate down to 3.25%.

“One fly in the ointment, however, is the high-side wage expectations for 2026. That is keeping the BOE cautious, but if the picture there were to soften then it could tilt the BOE away from its gradual easing path and open the window up for another cut in February.” he said.

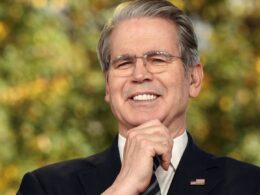

Bank of England Governor Andrew Bailey attends the central bank’s Monetary Policy Report press conference at the Bank of England, in London, on May 9, 2024.

Yui Mok | Afp | Getty Images

Morgan Stanley’s Chief U.K. Economist Bruna Skarica and strategist Fabio Bassanin said in a note that they expect another trim in February on the back of a decline in inflationary pressures and a pick-up in the jobless rate. But they anticipated “conservative messaging” around future cuts when that next rate cut comes.

“Thereafter, purely on the evolution of the inflation and pay data, as well as what looks to be a stubborn jobless rate in our forecasts, we still think that the BOE can deliver two more rate cuts in the first half of 2026, in April and June.”

Source link