Stay informed with free updates

Simply sign up to the Exchange traded funds myFT Digest — delivered directly to your inbox.

Invesco’s campaign to persuade investors in its $411bn QQQ exchange traded fund to vote for change is beginning to look less like investor outreach and more like Tony Soprano running a shareholder relations desk.

For those of you who missed the previous episode, Invesco wants to bolster its bottom line by hundreds of millions of dollars a year simply by converting the legal structure of its Nasdaq 100-tracking QQQ ETF — the world’s most lucrative ETF — from an archaic “unit investment trust” to a more modern open-ended ETF.

This will allow it to pocket the money it is currently forced by investment trust rules to spaff on marketing the ETF — a cool $175mn last year and rising in line with its ballooning assets under management. Anticipation of that mouth-watering possibility has helped Invesco’s share price jump by 54 per cent since the plan was unveiled in July.

There is just one tiny catch. A majority of QQQ shareholders need to vote in favour of the switcheroo. And this has not proved straightforward to achieve, as many of them are retail investors who (astonishingly) are uninterested in fund structure arcana and have better things to do with their time.

Invesco originally hoped to hold a shareholder meeting on October 19 to nod through the change, but without the necessary votes this was adjourned to December 5.

With its “outreach” campaign to persuade shareholders to vote “Yes” still not bearing the necessary fruits by the eve of the rearranged meeting, Invesco reached for the metaphorical baseball bat to cudgel recalcitrant QQQ shareholders into submission with an offer (it hoped) they couldn’t refuse:

If the Proposals do not pass, we expect the Meeting to be adjourned to Friday, December 19, 2025 at 7:00 a.m. Central Time, meaning two more weeks of outreach and solicitation. Stop the calls, texts and mails by VOTING NOW!

Yet even this unveiled threat of even more harassment failed to sufficiently shift the dial, with a follow-up filing with the Securities and Exchange Commission last Monday saying more than 50 per cent of shareholders had voted in favour, but the crucial 51 per cent pro-change mark remained tantalisingly out of reach.

Holdout investors can therefore doubtless look forward to even more “proxy solicitation” from Sodali Fund Services, appointed by Invesco at a cost of $38.3mn to cajole shareholders to exercise their democratic power.

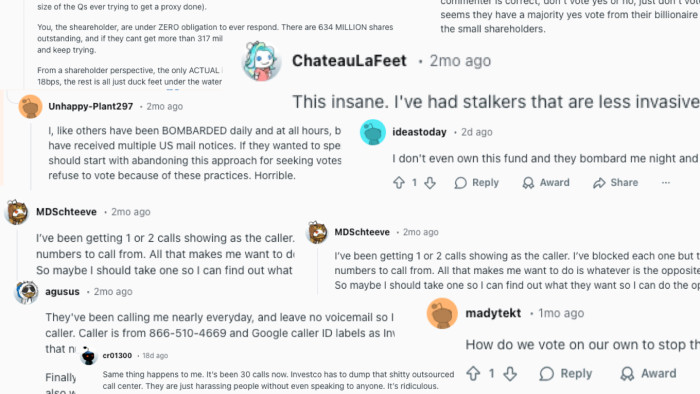

To be fair to Invesco/Sodali, they haven’t (yet) resorted to placing a horse’s head in the bed of those yet to cast their all-important vote. But they have done pretty much everything short of that, at least according to people of Reddit, who are QQQeing up [ed. note: we’re very very sorry] to vent their spleen.

Here’s a small but representative sample:

“I’ve been getting 3 calls a day every day, including weekends, plus 1 to 2 letters per week in the mail for the past two months. It’s horrendous and they won’t stop when asked. You’d think they were debt collectors.”

“I have currently received over 75 calls from them. 101 on how NOT to get my vote.”

“This [is] insane. I’ve had stalkers that are less invasive.”

“Is this even legal? it feels like harassment to me.”

“I, like others have been BOMBARDED daily and at all hours, by scammers and legit calls alike, plus have received multiple US mail notices. If they wanted to spend less on marketing perhaps they should start with abandoning this approach for seeking votes. It’s nothing more than harassment. I refuse to vote because of these practices. Horrible.”

“Regardless of the merit or not to make a change to open-ended ETF, why QQQ -Invesco is entitled to call every day including weekends? QQQ — Invesco calls from three times to six times per day.”

“Im still getting an insane volume of calls at every hour of the day including weekends! Today I blocked the number but I’ve even picked up and asked them to stop calling and they won’t stop. At this point I’m ready to sell my QQQ shares!”

While many Redditors say they were left none the wiser as to why they should vote (apart from to end the calls), one recurring theme among those who do understand the ramifications was the division of spoils.

If Invesco does success in badgering encouraging enough shareholders to vote in favour, investors will see their annual fees dip from 20 basis points to 18 bps (still above the 15 bps levied by QQQM, the Invesco Nasdaq 100 ETF, which tracks exactly the same index).

However Invesco will get their hands on all of the remaining revenues, bar a licensing fee paid to Nasdaq and Bank of New York Mellon’s slice of the pie for acting as trustee, which it is currently forced to spend on marketing the ETF. A previous filing put this at 5-6 bps, up to three times the saving being passed on to investors (and $200mn to $250mn a year, based on current AUM).

Uncharacteristically, the usually loquacious people at Sodali turned down the chance to speak to Alphaville and declined to comment, but Invesco offered up this statement:

By nature, the proxy process is extensive and enthusiastic to ensure that shareholders are aware of the proposed changes to QQQ, including the additional transparency and lower costs the modernization will provide.

Over 50% of QQQ shareholders have already voted in favor of these changes, and we feel obligated to continue the solicitation process to follow through on their preference.

The calls, it seems, will continue until consent improves.

Source link