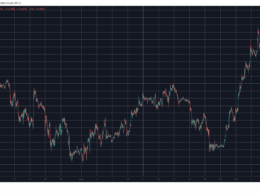

Mid-week, markets were rattled by an unexpected downturn that caught investors off guard despite an influx of seemingly bullish developments. The Federal Reserve announced the end of quantitative tightening (QT), the US and China agreed to a long-awaited “trade truce,” and two consecutive rate cuts hinted at a shift toward monetary easing.

On top of that, regulators approved an altcoin staking ETF. Despite this, rather than rallying, both Bitcoin and US equities sank. On-chain data pointed to weakening institutional demand, while Fed Chair Jerome Powell’s warning dampened the optimism.

As of Friday, sentiment remains fragile, as Bitcoin trades around $109,000.

Data That Predicted BTC’s Fall

Looking at the on-chain data, an important signal came from the Coinbase Premium Gap, which flipped negative again after briefly recovering. This metric, which measures the price difference between Coinbase (favored by US institutions) and global exchanges, has historically served as a proxy for American institutional demand.

A negative reading indicates that US investors are selling or avoiding accumulation, which means that Bitcoin’s price lacked strong institutional conviction. Retail traders, excited by macro “good news,” likely overestimated its impact, mistaking liquidity signals for continued demand.

In its latest analysis, CryptoQuant explained that the downturn was further fueled by Powell’s cautious tone. Although quantitative tightening will officially end on December 1, Powell’s insistence that a December rate cut is not guaranteed reignited doubts about the pace of monetary easing. This forced markets to reprice risk and ended up triggering declines across Bitcoin and US equities. In addition to the fragile US-China truce, geopolitical undercurrents, including the renewed US nuclear testing, added to investor unease.

Despite the near-term pullback, the crypto analytics firm stated that the correction aligns with cooling speculative excess. Institutional hesitation, temporary liquidity uncertainty, and geopolitical tension merely reset overheated sentiment. The firm believes that once QT fully ends and liquidity improves, risk appetite could gradually return, and aid in renewing the upside for Bitcoin and broader markets heading into early 2026, as long as monetary and geopolitical stability hold.

BTC Must Hold $98,000

The latest commentary from TeraHash’s analytics team implies that while BTC’s long-term uptrend remains intact, its momentum has clearly started to cool. In a statement to CryptoPotato, the team said that if the Feds continue cutting rates and macro conditions remain supportive, Bitcoin could establish a new all-time high by late 2025 or early 2026.

For now, they view $98,000 as a crucial support level; a breakdown below it could drag the crypto asset to as low as $70,000 if selling pressure deepens.

“At this stage, it’s crucial for Bitcoin to hold the $98,000 level. Losing it could easily push the price down toward the $90,000-$74,000 range. If these levels fail to hold, a deeper correction to the $70,000-$60,000 zone becomes likely. Still, it’s important to consider that Bitcoin has attracted investments from the world’s largest funds and continues to gain legitimacy in the public eye.

This suggests that any correction is unlikely to happen abruptly or impulsively. If the Fed continues its interest rate cuts and global macroeconomic conditions remain favorable, we could see Bitcoin reach a new all-time high either by the end of this year or in early 2026.”

The post Why Ending QT and Cutting Rates Still Did Not Save Bitcoin (BTC) appeared first on CryptoPotato.

Source link