After weeks of steady decline following its summer rally, XRP is now attempting to recover from significant technical damage on both the USDT and BTC pairs.

While the macro structure still holds some bullish characteristics, the recent breakdowns highlight growing uncertainty, with buyers now needing to reclaim key levels to regain control.

Technical Analysis

By Shayan

The USDT Pair

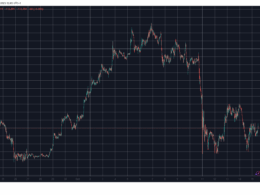

XRP is on the verge of breaking below the ascending channel it had been respecting for most of the year. The price dipped sharply toward the $2.00 area before showing signs of recovery, now trading around $2.46. The 100-day and 200-day moving averages (blue and orange) have also now turned into resistance elements above the price at around the $2.90 and $2.60 levels, respectively.

The altcoin needs to reclaim these moving averages quickly to avoid further bearish continuation. If the current rebound fails and price rolls over again, the $2.00 level may be retested, with a deeper drop into the $1.00 – $1.30 demand zone becoming more likely.

The BTC Pair

XRPBTC has also undergone a breakdown below key moving averages and structure. The price fell sharply below the 2,400 SAT and is currently trading around 2,280 SAT, testing the lower support zone around 2,000 SAT. The RSI is also around 40, reflecting bearish momentum.

This move marks a significant shift in momentum, as XRP has now lost both 100-day and 200-day moving averages. If the 2,000 SAT area fails to hold, the next support rests near the 1,500 SAT orderblock, followed by the 1,150 demand zone. On the upside, any recovery attempt would first need to reclaim the 2,400 SAT level and close above the moving averages to signal strength.

Overall, XRP is at a critical juncture on both charts. The coming days will determine whether this is a short-term shakeout or the beginning of a deeper corrective phase.

The post Ripple Price Analysis: Bears Take Control and Eye $2 for XRP appeared first on CryptoPotato.

Source link