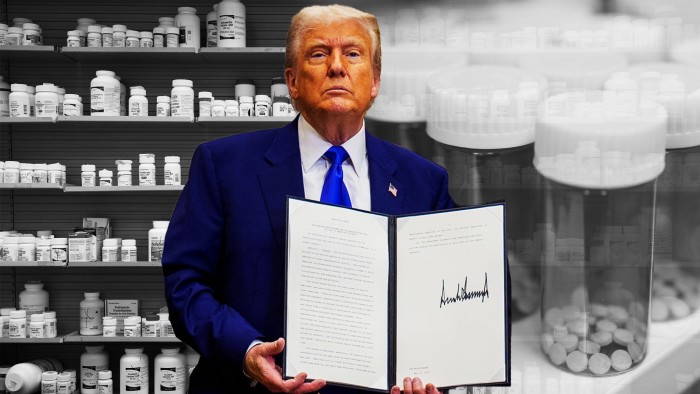

Donald Trump has vowed to cut the US’s globally high drug prices by as much as 80 per cent with an executive order that seeks to force other countries to pay more for their medicines.

The president’s order published on Monday targeted “foreign nations freeloading on American-financed innovation”, arguing they should take on a higher share of costs for the research and development of new medicines.

“Americans will no longer be forced to pay almost three times more for the exact same medicines, often made in the exact same factories,” the order said. “As the largest purchaser of pharmaceuticals, Americans should get the best deal.”

What does Trump’s order do?

It instructs Robert F Kennedy Jr, health and human services secretary, to communicate and enforce targets to bring down US drug prices. These “most favoured nation” benchmarks are intended to match American costs with the lowest in comparably developed countries. The prices themselves are not yet defined.

Drugmakers will face “additional aggressive action” if prices are not brought into line with those elsewhere, according to the order. Potential actions include the revocation of drug approvals and trade penalties against nations that do not co-operate. That raises the possibility that the issue could become entangled in the the president’s wider tariff war.

A second aspect of the directive seeks to allow consumers to buy medicines directly from drugmakers that offer so-called favoured nation prices. This provision sent a chill through the stock prices of pharmaceutical intermediaries. Shares of Cigna and CVS, two big drug- negotiating businesses, tumbled amid a broad stock market rally.

Drug prices vary greatly around the world because many countries can negotiate with manufacturers using the buying power of state or state-backed health bodies.

The US is an exception among its industrialised peers since its government-backed insurers have historically not negotiated with drug companies, contributing to higher costs.

What will be the impact on pharmaceutical companies?

Individual companies have struck a conciliatory, if cautious, note. Anglo-Swedish AstraZeneca said it shared Trump’s commitment to “ensuring that the cost of pharmaceutical innovation is fairly shared among high-income nations”.

It added that the most favoured nation status would need to be carefully implemented to avoid “disrupting patient care, undermining US leadership in biotechnology, and stifling the innovation that drives global health advancements”.

Novo Nordisk, maker of the blockbuster diabetes and weight-loss drugs Wegovy and Ozempic, said it agreed that Americans needed “more access to affordable medication”. It said it would continue to engage with policymakers and looked forward to learning how the executive order would “work within the current US healthcare system”.

PhRMA, the US industry body, has seized on the administration’s framing that other countries, rather than drugs companies, are the biggest problem. “We need to address the real reasons US prices are higher: foreign countries not paying their fair share and middlemen driving up prices for US patients,” it said.

Trump’s tone was “relatively positive for the industry”, said Trung Huynh, an analyst at UBS. The president’s main goals of increasing drug prices outside the US and reforming the system of healthcare intermediaries in the country could even be a “tailwind” for drugmakers if successful, he added.

For pharmaceutical companies, the executive order’s lack of specifics was a relief. The order was “all bark, little bite” and would not rattle the biotech sector, analysts at RBC Capital Markets wrote in an investor note.

What has been tried in the past to lower US drug prices?

In his first term, Trump talked about lowering US pharmaceutical prices, blaming “foreign freeloaders” for high charges. He claimed that the American price premium amounted to consumers paying too large a share towards companies’ global research and development costs.

But Trump failed in a previous attempt to bring down prices. He announced in late 2020 that he wanted to set drug prices for seniors at the lowest level in the industrialised world, but his effort foundered on industry opposition, including legal action, and his departure from office in January 2021.

Under former president Joe Biden, Congress passed legislation that would allow the government to negotiate prices for 10 drugs. Merck and other pharmaceuticals companies have sued to stop the price talks. The cases are ongoing.

In April, Trump signed a less extensive executive order for the Food and Drug Administration to allow states to import medicines from countries where prices are lower. The move followed the FDA’s authorisation last year for Florida to source drugs from Canada.

The April order also sought to modify Biden’s system of limited drug price negotiation after the pharmaceutical industry criticised the move.

How likely is it that Trump’s order will lower drug prices for Americans?

Analysts said the lack of specific information in the executive order made it hard to predict its eventual impact. The order is a statement of intent and has no legislative authority. It lacks important details such as which countries, disease areas or aspects of Medicare are to be prioritised.

Many analysts are sceptical the price cut plan will work, given the failure of previous efforts. While the most favoured nation proposal could cause some short-term volatility in biopharma company drug prices, it was unlikely to stick, said Tim Opler, a managing director at US investment bank Stifel.

“While no one can predict with certainty what will happen with the [most favoured nation] proposal, we think this is likely to be end up being yet another paper tiger that has roared at the pharma industry.”

Source link