Unlock the White House Watch newsletter for free

Your guide to what Trump’s second term means for Washington, business and the world

US aerospace and defence manufacturers have warned of higher costs as the turmoil from Donald Trump’s trade war continues to disrupt the industry’s global supply chains.

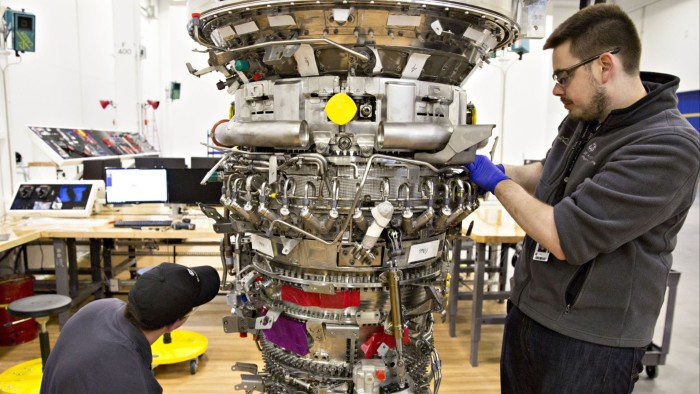

Larry Culp, chief executive of GE Aerospace, said the jet engine maker would rely on price increases and other measures to reduce the impact of tariffs on its business even as the company reaffirmed its full-year earnings forecast. Culp said he had urged President Trump and other people in the administration to restore the industry’s tariff-free regime.

“We have been . . . full-throated in our support of the administration’s efforts to support American competitiveness and revitalise American manufacturing,” Culp told analysts on an earnings call.

However, it was “easy to overlook the $75bn trade surplus the sector enjoys largely on the back of this tariff-free regime that we’ve had since 1979”, he added.

The trade war has triggered the greatest uncertainty in the sector since the Covid pandemic, disrupting its closely integrated supply chains and prompting debate over who will end up paying the additional costs from the duties.

Apart from an 18-month period of levies imposed as part of the dispute over subsidies for Boeing and Airbus, the industry has largely operated without trade barriers since 1979.

GE, said Culp, had suggested the administration “consider the position of strength that the country enjoys as a result of this tariff-free regime, and to consider re-establishing the same”.

The trade war is also expected to hit GE’s spare engines and spare parts deliveries to China, according to Culp.

Shares in GE were up 4.8 per cent on Tuesday as investors shrugged off the tariff uncertainty and focused on the company maintaining its full-year guidance.

The RTX stock, meanwhile, fell 8.5 per cent after the group warned it could suffer an $850mn hit to pre-tax operating profit if Trump’s tariffs on steel and aluminium imports and goods arriving from China, Canada and Mexico were to stay in place until the end of the year.

RTX’s Pratt & Whitney subsidiary builds jet engines for civil aircraft while its Raytheon defence unit is the maker of the Patriot missile defence system. The company reported better than expected financial results and maintained its financial outlook.

Shares in Northrop Grumman fell as much as 13 per cent on Tuesday, the biggest intraday decline since March 2020, after the defence contractor said net earnings almost halved year-on-year to $481mn.

Higher manufacturing costs on its B-21 stealth bomber programme meant the company posted a pre-tax loss of $477mn in the first quarter of 2025. Asked on its earnings call about tariffs, Northrop said it sources about 5 per cent of its total spend, or less than $1bn, from outside the US, adding that it does not see “a significant risk to our company related to [US] trade policies”.

Source link