Unlock the White House Watch newsletter for free

Your guide to what the 2024 US election means for Washington and the world

Donald Trump said he had authorised a 90-day pause in additional tariffs on a wide range of countries that were willing to negotiate with the US, the first sign that the president was retreating from a full-blown trade war.

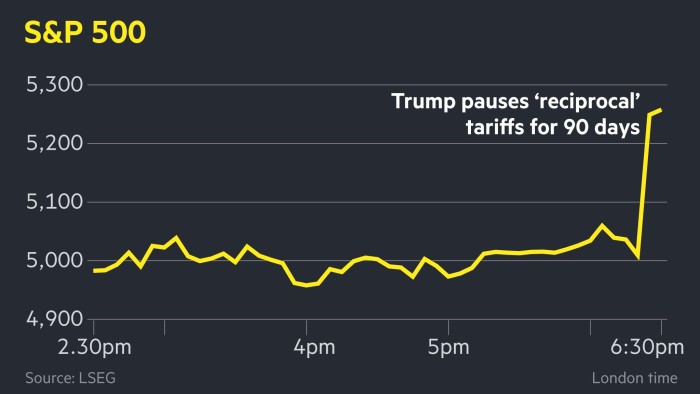

Wall Street equities soared immediately after Trump’s announcement, with the blue-chip S&P 500 surging more than 7 per cent and the Nasdaq Composite up almost 9 per cent.

The massive rally in Wall Street stocks added about $3.2tn to the market value of the S&P 500 on Wednesday by 2pm in New York, according to Financial Times calculations based on FactSet data.

However, Trump also singled out China for further tariffs, increasing his additional levies on the world’s second-largest economy to 125 per cent, deepening his trade stand-off with the Asian nation.

“Based on the fact that more than 75 Countries have called . . . to negotiate a solution…and that these Countries have not, at my strong suggestion, retaliated in any way, shape, or form against the United States, I have authorized a 90 day PAUSE, and a substantially lowered Reciprocal Tariff during this period, of 10%, also effective immediately,” Trump said in a Truth Social post.

But China had showed a “lack of respect” by retaliating against US tariffs, Trump added. “I am hereby raising the Tariff charged to China by the United States of America to 125%, effective immediately.”

The climbdown from the US leader came after a week of turmoil in global markets, with trillions of dollars shed in equity prices around the world, a sharp sell-off in US bonds, and a plunge in oil prices to levels last seen during the coronavirus pandemic.

Commerce secretary Howard Lutnick said the “world is ready” to work with Trump to “fix global trade” but dismissed China as having “chosen the opposite direction”, as markets jumped in response to the US president’s announcement on Wednesday.

The commerce secretary added on X that he and Treasury secretary Scott Bessent “sat with the President while he wrote one of the most extraordinary Truth posts of his Presidency”.

Wall Street banks had warned that the levies would send the US economy into recession while boosting inflation and unemployment.

Companies that had been beaten down in recent days posted huge gains on Wednesday after Trump’s climbdown. Tesla, Apple and Nvidia all jumped more than 10 per cent following Trump’s announcement. The gains will help reverse the heavy losses posted for US stocks since Trump announced his wide-ranging tariffs last Wednesday.

“To the extent that tariffs are not put into force, that’s a good thing from an economic perspective. To the extent that the trade war becomes just between the US and China, that eases pressure on other countries and on the global economy,” said Eric Winograd at AllianceBernstein.

The climbdown ushers in a phase of what are expected to be multiple, parallel trade negotiations between the US and its top trading partners over the coming weeks to try to resolve commercial tensions.

Bessent on Tuesday announced he would lead talks with Japan, alongside Trump’s top trade negotiator, Jamieson Greer, in an effort to strike a deal that could see tariffs lowered.

The move came after days of mixed messages from Trump administration officials over how durable the tariffs would be and whether the US was open to talks with its trading partners that could see them lowered.

Greer was giving testimony in front of the House of Representatives’ ways and means committee when Trump announced his pause.

“WTF, who’s in charge?” Steven Horsford, the Democrat lawmaker from Nevada, shouted at Greer moments after Trump announced the pause.

Horsford asked Greer if he was aware that the president had just paused his tariffs. Greer replied that he had been aware the proposal had been “under discussion”.

But even as Trump pauses his plans for aggressively higher tariff rates on many countries except China, he is still maintaining the 10 per cent blanket levy on most imports from around the world that took effect on April 5.

Source link