Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Walmart said its short-term profit outlook has become less predictable, blaming in part efforts to keep prices low as US President Donald Trump imposes heavy tariffs on major trading partners.

The largest US retailer imports more than $100bn of merchandise a year to the country, analysts estimate, exposing its business to escalating tariffs that include a 104 per cent levy on China that took effect on Wednesday.

Walmart made the announcement as senior executives took the stage at a long-planned presentation to Wall Street fund managers and analysts in Dallas.

“I’ve seen us navigate times like the period after 9/11, the global financial crisis, the pandemic and more recently high inflation,” Doug McMillon, chief executive, said at the event. “While in the short term, we’re not immune to some of the effects, we’re positioned to play offence.”

The company has been winning market share from other retailers as it uses negotiating heft to maintain the lowest prices in many categories, attracting consumers stretched by inflation.

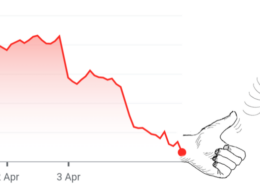

But Walmart’s stock price has tumbled nearly 20 per cent after reaching a record high in mid-February as investors worry about Trump’s escalating trade wars.

Walmart had previously forecast that adjusted operating income in the first quarter set to end this month would increase by 0.5 to 2 per cent.

On Wednesday it offered a less certain picture, saying the range of profit outcomes for the quarter “has widened” due in part to a “desire to maintain flexibility to invest in price as tariffs are implemented” — retail jargon for efforts to hold down prices, an action that can put pressure on profit margins.

Walmart stood by its previous forecast for first-quarter sales growth of 3-4 per cent. It also reaffirmed guidance for the fiscal year for sales to increase by 3 to 4 per cent and operating income to rise by 3.5 to 5.5 per cent.

Shares of the Bentonville, Arkansas-based company rose by 3.5 per cent in early trading after executives stood by longer-term targets for sales to rise by an average of 4 per cent a year, and for operating profits to grow more quickly than that.

“Nothing about the current environment impacts our confidence in our business or our strategy,” McMillon said.

Walmart’s US businesses reported nearly $560bn in revenue last year. Over two-thirds of what Walmart sells in the US is made or grown in the country, executives say. Yet Walmart ranks among the largest US merchandise importers, shipping volumes worth more than the entire annual sales of most American retail rivals.

“I think the administration has admitted themselves that there’s going to be disruption and there’s going to be price impacts,” Dan Bartlett, Walmart’s executive vice-president of corporate affairs, said in an interview with the Financial Times on Tuesday. “And the good thing about Walmart is that it’s in our DNA to keep prices low. We will fight it harder and better than anyone else.”

Source link