For college hopefuls, there is a letter that is arguably more significant than an acceptance notification: the financial aid award.

Nearly 75% of all undergraduates receive some type of financial aid, according to the National Center for Education Statistics.

For a majority of students and their families, financial aid is the most important factor in their decisions about choosing where to attend and how to pay the tab. The amount of aid offered matters, as does the breakdown between grants, scholarships, work-study opportunities and student loans.

And yet, “the system lacks transparency, especially around the true cost of attendance, making it very difficult for families to comparison shop and make informed financing decisions about their education,” said Rick Castellano, a spokesperson for education lender Sallie Mae.

More from Personal Finance:

College hopefuls have a new ultimate dream school

How Musk’s DOGE took over the Education Department

$2.7 billion Pell Grant shortfall poses a threat for college aid

“Financial aid offers are a good example,” he said. “There isn’t a standard format and it can be difficult to determine what is grant and scholarship aid versus what needs to be paid back, making it tough for families to compare and fully understand what’s being offered.”

Understanding the financial aid offer

In most award letters, there are often several financial aid options, including grants, scholarships, work-study opportunities and student loans.

The goal is to maximize gift aid — such as scholarships, fellowships and grants — and minimize loans that will need to be repaid with interest, Castellano said.

But even with gift aid, it’s important to read the fine print, such as whether a grant is renewable for all four years or if a minimum grade point average must be maintained. It’s worth noting that if a student fails to meet the terms, like a GPA requirement, they may have to repay some or all of a grant or scholarship.

Ultimately, “a bigger financial aid offer may not be better, especially if it includes more loans to cover expenses,” Castellano said.

Some federal loan programs allow students and families to borrow virtually unlimited amounts, he said, leading to ballooning debt burdens. The average undergraduate loan balance is currently around $30,000, according to the College Board. But as a general rule, experts advise students against borrowing any more than they absolutely need.

There may be more college aid available

“Even after receiving aid offers, there’s still money out there,” Castellano said.

For families who have already filed the Free Application for Federal Student Aid, or FAFSA, but are concerned about making ends meet, it is possible to ask the college financial aid office for more aid, especially if your financial circumstances have changed.

To appeal for more college aid, document any changes in assets, income, benefits or expenses. Or, if the financial aid package from another comparable school was better, that is also worth noting in an appeal.

In fact, 71% of families who appealed their financial aid offers in the 2023-24 academic year received additional funding, according to Sallie Mae.

How changes at the Education Dept. factor in

This year, the U.S. Department of Education, which is responsible for underwriting student loans and disbursing college aid, is in the middle of a massive upheaval, after slashing nearly half of its staff.

The agency said in a press release on March 11 that it would “continue to deliver on all statutory programs that fall under the agency’s purview,” including Pell Grants and student loans.

Still, the Education Department also runs the FAFSA and handles oversight of colleges, such as audits and program reviews, as well as technical support to college financial aid offices — and staffing cuts could impact what support is available, according to higher education expert Mark Kantrowitz.

“There might be delays in responses to student and borrower inquiries and the accuracy of the responses may be affected,” he said.

When in doubt, turn to private scholarships

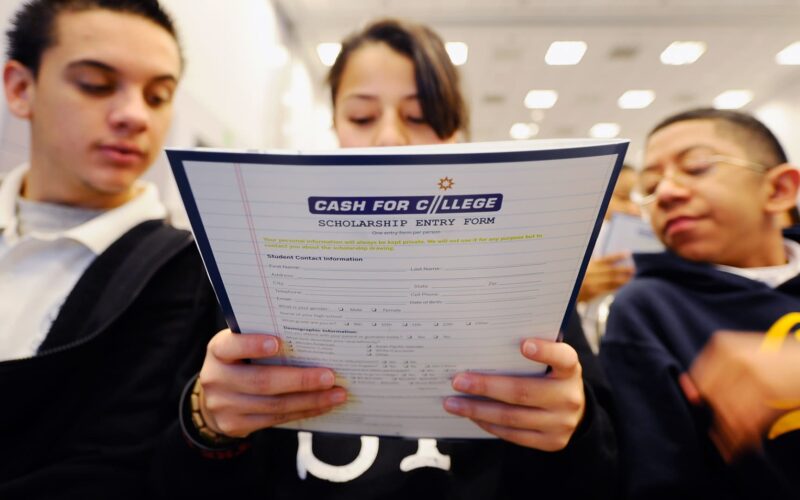

High school students attend Cash for College, a college and career convention, in Los Angeles.

Getty Images

In addition to the collage aid offer, there are more than 1.7 million private scholarships and fellowships available, often funded by foundations, corporations and other independent organizations, Kantrowitz said. The total value of those awards is more than $7.4 billion.

It’s never too late to tap alternative sources for merit-based aid, according to James Lewis, co-founder of the National Society of High School Scholars, an academic honor society.

“A lot of families assume they won’t be eligible for scholarships,” he said — that’s not the case. Scholarships could help bring a pricier school within budget.

“Get beyond, ‘Well, I can’t afford that,'” Lewis added. “Don’t self-select out.”

If you’re pursuing this strategy, check to make sure your college of choice doesn’t have a so-called displacement policy, which could mean private scholarships will reduce other sources of aid.

Continue to look for more scholarships, even through the spring, Lewis advised. “My advice to students and their families is to research and apply often. Google is their best friend.”

Students can also ask their high school counselor about opportunities or search websites such as Scholarships.com or the College Board.

Source link