Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The writer is founder and chief executive of asset manager Capstone Investment Advisors

It was only a matter of time before mixed signals on policy in the US would translate into higher volatility. When trade tariffs are on, then off, then on again, for example, markets have to adjust to the odd reality we’re living in. The Vix — an indicator of investor expectations of volatility in the S&P index — has risen sharply since mid-February. Given the risks of a systematic dismantling of trust between nations, index volatility might have risen even more.

Some market participants active in trading volatility have long been anticipating such a shift — particularly given that the dispersion of individual stock moves, the hidden underbelly of index volatility, had been intensifying. The performance of the Magnificent Seven tech companies that dominate the US stock market and other big companies had disguised a broader divergence among stocks.

President Donald Trump’s administration could be a good thing for assets in the longer term and a good thing for growth in the eyes of many market participants. But we can’t overlook that single stock volatility, as a function of idiosyncratic risk, is steadily trending higher relative to index volatility.

It isn’t just the content of recent executive orders from the White House that creates larger swings — or the mostly commonly cited suspects, like geopolitical conflict, inflation and supply chain disruption. Unpredictability in part comes from how policy decisions are messaged. I have no doubt that the advent of social media platforms such as Truth Social and X are a significant consideration in how investors approach research. Not least now, when decisions are more frequently communicated through these channels.

Trump’s tendency to comment on specific industries, companies, events and actions by other nation-states is a driving force for investor sentiment. What is gleaned from his views alters the course of fate for certain sectors — in particular those more exposed to government support in the form of subsidies or tax advantages, such as renewable energy.

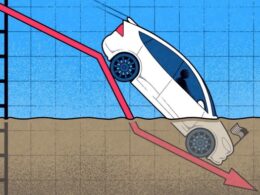

And greater uncertainty, and thus dispersion, is not just a matter of communication. There are some fundamental issues. Take electric vehicles, for example. There is a clear tension between Trump’s stated goal of reconstituting the traditional American automotive industry and the interests of Tesla, the largest auto company by market cap. What might be good for Tesla might not be so for the traditional carmakers and vice versa. Moreover, Elon Musk, the man running this company, is also tasked with drastically reducing government spending, and appears to have the president’s ear.

Likewise, artificial intelligence has been a market favourite over the past two years, but investors have yet to grapple with its implication for the labour market. How will voters respond if job cuts due to AI automation pick up meaningfully? And how will Trump respond to those concerns, especially if they are voiced by people that voted Republican in 2024? These questions may have to be answered sooner than investors think.

How about healthcare, construction, and food processing? These sectors may struggle to find workers if policies to restrict migrant labour are enacted. If the labour force in those industries contracts, prices for healthcare services, housing and food may increase, hurting consumer pocketbooks. The administration will then have to make difficult policy choices that will have clear winners and losers.

For investors, swirling dispersion beneath the S&P 500 is significant in other ways, too. That essential policy directions are made on social media without being trailed in traditional media first means that outperforming the market trend, or alpha, requires monitoring the personal feeds of the president and a few of his confidantes. Data is having to be gathered in a different way, from discrete sources that are challenging to standardise.

The increasing importance of dispersion on returns also has its own repercussions for portfolio construction. Investors should take note of the hidden risks associated with over-dependence on and exposure to particular categories of stocks.

Tariff-sensitive stocks are the tip of a widening array of sector categories extremely sensitive to policy change. And, while there will be many successful companies with their heads above water, profound writhing in the undercurrents of indices is ignored at peril.

Capstone holds investment positions in volatility markets

Source link