Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

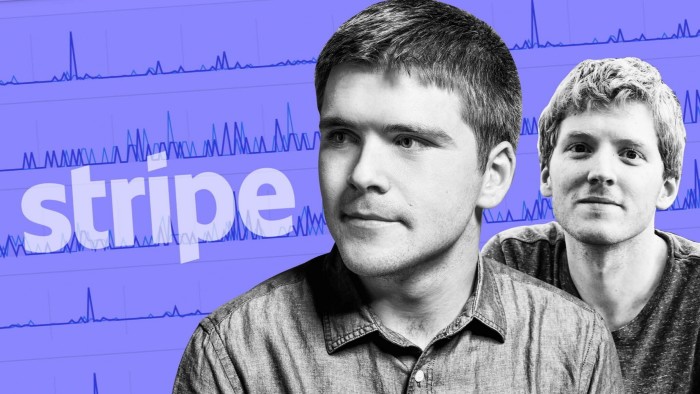

Stripe has shot back to a valuation of more than $90bn, in a sign of rebounding fortunes for financial technology businesses that have been boosted by a surge in demand from artificial intelligence companies.

The Irish-American payments and billing company is selling shares to investors as a way of letting long-term employees cash out their stakes. The sale gives Stripe a valuation of $91.5bn, up from $70bn six months ago and close to the company’s peak valuation of $95bn in 2021.

The deal also eases any pressure on the 14-year-old company to launch an initial public offering. John Collison, Stripe’s president and co-founder along with his brother Patrick, said Stripe had “no plans to IPO”.

“We’ve stayed private longer than most tech companies, and that’s been a positive,” he said. “We can plough profits back into R&D [research and development]. But we’re not dogmatic . . . We decide what’s best for the business on an ongoing basis.”

The company has been profitable for the past two years and will continue to be profitable for the foreseeable future, Collison added, without giving specific figures.

Stripe was one of the most high profile of a group of Silicon Valley start-ups that rode ultra-low interest rates and a massive increase in the amount of capital flowing to private companies in the years leading up to 2022.

But a steep rise in interest rates and growing economic uncertainty as a result of Russia’s invasion of Ukraine caused a sharp reversal for start-up valuations, with Stripe plunging from its peak valuation of $95bn to $50bn in 2023. The company has since rebounded, along with other fintech start-ups including Chime and Klarna, both of which are preparing to go public.

Collison said high valuations for private companies were more sustainable now than they had been at the crest of an investment frenzy in 2021 and 2022, largely owing to the impact of AI on companies’ revenue and growth.

“Prior booms perhaps had a more speculative flavour. These [AI] companies that are very fast-growing have very steep revenue ramps, because the products are very useful. You should be able to see real impact,” he said, citing reductions of fraud and an increase in payment success rates.

Individual companies may be hit. But he added: “Is this going away as a sector? Absolutely not. Companies are voraciously buying what [AI start-ups] OpenAI, Anthropic and Cursor have to sell because it provides use to them. You can have self-referential speculative bubbles like crypto, but AI is driven by real utility.”

Stripe processed $1.4tn in payments in 2024, up 40 per cent on 2023, in what the company described as an “unusually good year”. The group plans to process a greater number of payments made using stablecoins, which track the price of a reserve sovereign currency, after acquiring stablecoin platform Bridge for $1.1bn last year.

Source link