Unlock the White House Watch newsletter for free

Your guide to what the 2024 US election means for Washington and the world

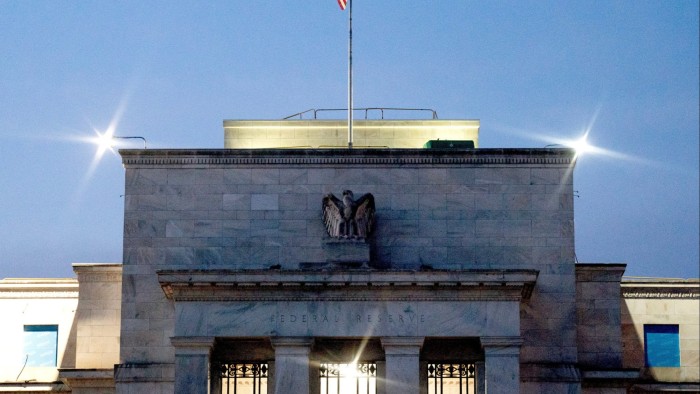

Democrats are demanding that Donald Trump’s nominee to be a top US economic adviser commit to the independence of the Federal Reserve, as Congress scrutinises the president’s efforts to gain more control over the central bank.

Elizabeth Warren, the top Democrat on the Senate banking committee, has sent a letter to the White House asking Stephen Miran, Trump’s nominee to chair the Council of Economic Advisers (CEA), whether he would “commit to supporting the Fed’s independence from political influence”.

The letter, dated February 21 and seen by the Financial Times, comes ahead of Miran’s confirmation hearing before the committee in the Republican-controlled Senate on Thursday.

Trump has used the first month of his second term to expand the reach of his executive powers, including by tightening White House control over independent agencies and regulators.

Last week, Trump signed an executive order to rein in independent financial watchdogs, directing them to “consult” with the White House on “their priorities and strategic plans”. The Fed’s supervisory role of the financial sector was targeted, though its monetary policy functions were exempt.

The CEA is a three-person group that advises the president on economic policy, and its chair can be an important influence on economic matters.

Miran, who served as a policy adviser to the Treasury department during Trump’s first term, is an outspoken critic of Fed chair Jay Powell. He has also called for the scope of the central bank’s independence to be narrowed, arguing that it does not actually operate autonomously and is inherently in tension with the US constitutional system.

In a paper last year advocating for Fed reform, Miran wrote that the bank’s “pure independence is incompatible with a democratic system”, and its governance structure has instead “led to significant monetary-policy errors”. It has “pursued a much more expansive monetary and regulatory agenda that is more consistent with an explicitly political institution”, he claimed.

Miran has hit out at Powell for urging more aggressive fiscal and monetary stimulus in October 2020, about a month before that year’s election, to aid the economic recovery amid the Covid-19 pandemic.

“Powell was wrong politically and economically when he urged Congress to ‘go big’ on fiscal stimulus in October of 2020, on the eve of a Presidential election”, he wrote on X in September.

One of his proposed reforms was to make Fed board members and branch leaders subject to removal by the president at will.

In her letter to Miran, Warren asked: “Do you believe the president can fire at-will a [Fed] board official?” She also probed him on whether he “support[s] proposals to remove the Fed’s responsibility to promote full employment” from the bank’s dual mandate.

The Fed is facing the fiercest challenge to its independence to set interest rates since the 1980s, with Trump calling on Powell to lower borrowing costs. The Fed chair has defended the bank’s authority over US monetary policy and has vowed to stay above the political fray.

Warren’s 27-page letter asked Miran to state his positions on various core economic policy areas including Trump’s tax and trade agendas, economic forecasts and fiscal policy, lowering prices, financial regulation and the economic impact of immigration.

The senator also expressed concern over Miran’s potential conflicts of interest. He is a senior strategist at Hudson Bay Capital, a large hedge fund.

The White House and Miran did not respond to requests for comment.

Additional reporting by James Politi in Washington

Source link