Bitcoin has been consolidating above a crucial support region, signaling strong buyer interest and a potential bullish breakout.

If BTC reclaims the $108K resistance, it could trigger a short liquidation cascade, propelling the price toward $115K.

Technical Analysis

By Shayan

The Daily Chart

Bitcoin’s price action remains on a bullish trajectory, with the ascending channel’s middle trendline acting as a strong support zone in recent months. This dynamic support has repeatedly held price declines, reflecting buyer confidence and a resurgence in demand.

Following this support test, Bitcoin surged toward its all-time high of $108K, a key resistance region with concentrated supply and selling pressure. The asset is now consolidating within a tight range, bound by the channel’s middle trendline and the static $108K resistance.

Given that liquidity grabs have already occurred above $108K and below $90K, a breakout appears imminent. If bullish momentum strengthens, reclaiming $108K could fuel a sharp rally driven by short liquidations and increased buying pressure toward $115K.

The 4-Hour Chart

In the lower timeframe, BTC’s buyers stepped in at the $90K support, preventing further declines. Following a liquidity sweep below $90K, Bitcoin surged toward the $108K resistance zone, where the ascending channel’s middle boundary aligns with its ATH, reinforcing this level as a major inflection point.

The ongoing consolidation at $108K reflects a battle between buyers and sellers, making this region a pivotal price level. A breakout and consolidation above $108K could signal a sustained rally toward new ATHs. However, a rejection from this level might trigger a retracement toward the channel’s lower boundary at $98K.

Sentiment Analysis

By Shayan

Bitcoin’s recent uptrend has traders closely watching whether it can break above its all-time high of $108K. The key factor in this potential breakout is whether the market can generate enough momentum to surpass this critical resistance level.

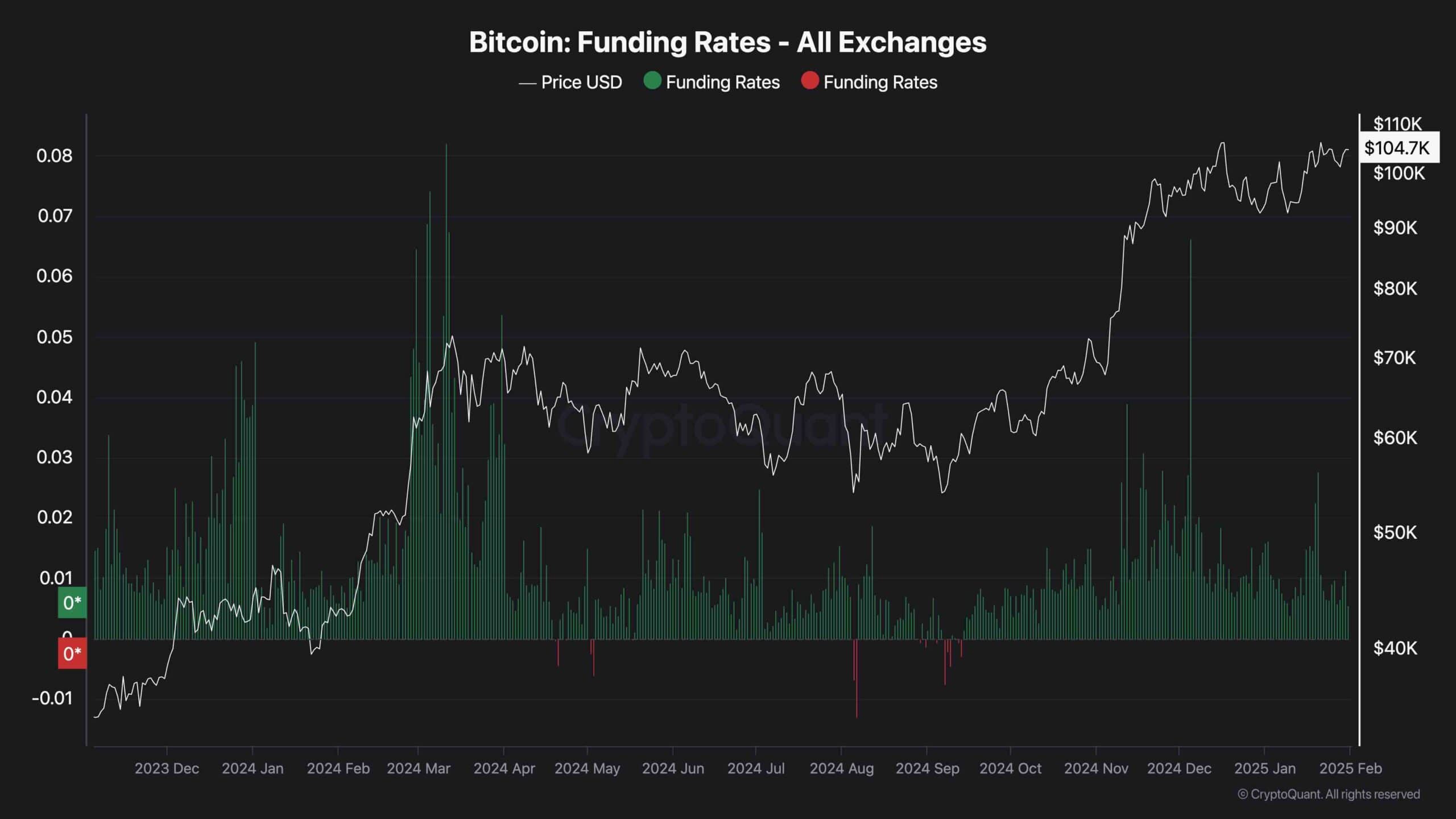

A crucial on-chain indicator, the funding rates metric, has shown a bearish divergence. While Bitcoin’s price has surged toward ATH, funding rates have declined, suggesting weak demand in perpetual markets. This divergence indicates that bullish momentum may not be strong enough to support a breakout.

For Bitcoin to decisively breach $108K, the funding rates must rise further, signaling an increase in optimism and a greater influx of long positions. Without this market-wide enthusiasm, the resistance at $108K could hold, leading to potential consolidation or a temporary rejection.

The post Bitcoin Price Analysis: This Is BTC’s Road to $115K appeared first on CryptoPotato.

Source link